Community & Environment Search articles

On the Move Search articles

Growing Hamilton Search articles

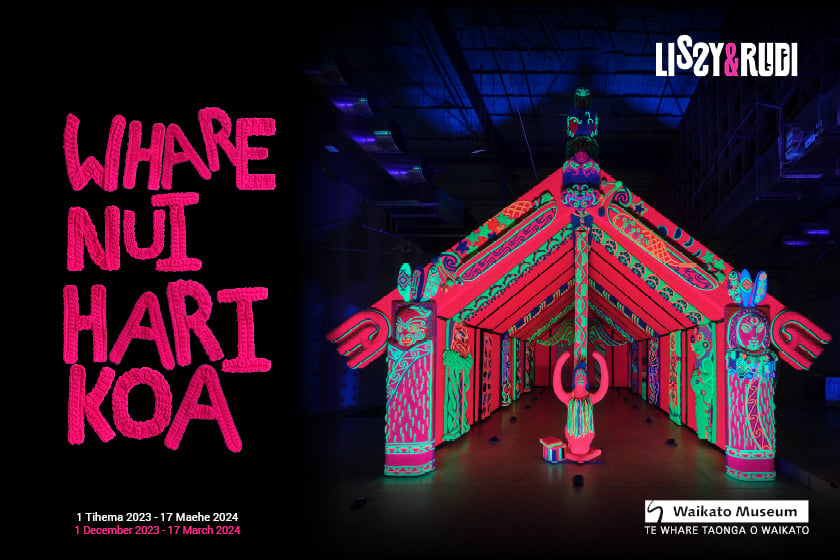

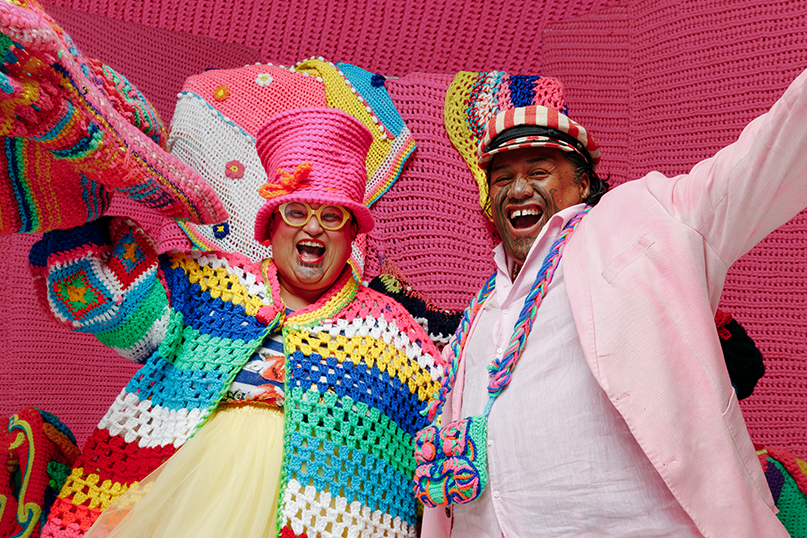

Culture & Events Search articles

Latest News Search articles

Sign up to receive updates

Want to get the latest news straight to your inbox? Sign up below!